Art is the best investment I’ve ever made in myself. Collecting art has filled my life with joy and life-changing experiences. However, if you’re looking for a surefire investment asset, don’t buy art.

Especially when you start dropping hundreds of thousands of dollars on it, we’d all love for our art to increase in value. Regardless of the stories you hear, though, most art never appreciates. You’re blessed enough to live with art you love.

That said, there are some things you can do to increase the odds that your collection might at least hold some value.

The easiest way to make a good art investment is to buy the rarest artworks made by artists who’ve already stood the test of time. Cough up $33 million for a Monet oil painting, and you’re likely see its value increase.

It really pains me to say it (sorry artists!), but buying works by dead artists can be a safer bet for value retention. Only living artists can produce more works, so the rarity of the works by dead artists is a known quantity.

Just because a work is old and well painted, doesn’t mean it’s worth a lot of money. A few years ago, I saw a gorgeous 500-year-old figurative painting sell at Sotheby’s for only $11,000. There was nothing wrong with it—no doubt whoever owns it is ecstatic about having it in their life this very minute. The painting only sold for so little because the market for Old Masters has been lousy for several years and it wasn’t by a famous artist. The DaVinci that sold last year for $450 million had everything to do with the painting being a DaVinci. When nobody knew it was a DaVinci, the exact same painting sold 10 years earlier for only $10,000.

Even work by dead artists isn’t even a sure thing. Plus, it doesn’t have a PowerBall ticket of upside. Like most Old Masters art right now, the artistic style might fall out of favor. Living artists have the advantage of the ability to produce new works that might significantly increase the overall market value of their work, especially if you catch them early in their careers.

Buy the best works you can afford. Whenever you can, buy unique works—meaning the only ones of their kind, not editioned works. Also buy the biggest works you can manage. Yup, size matters, in a Goldilocks way. Buy big, but not too big. Few collectors have the space for monumental works, so they tend to lose value and are very hard to sell at all, but large works often have more wow factor than small ones. Bigger works also typically sell for more than smaller ones since more materials and labor are initially put into them.

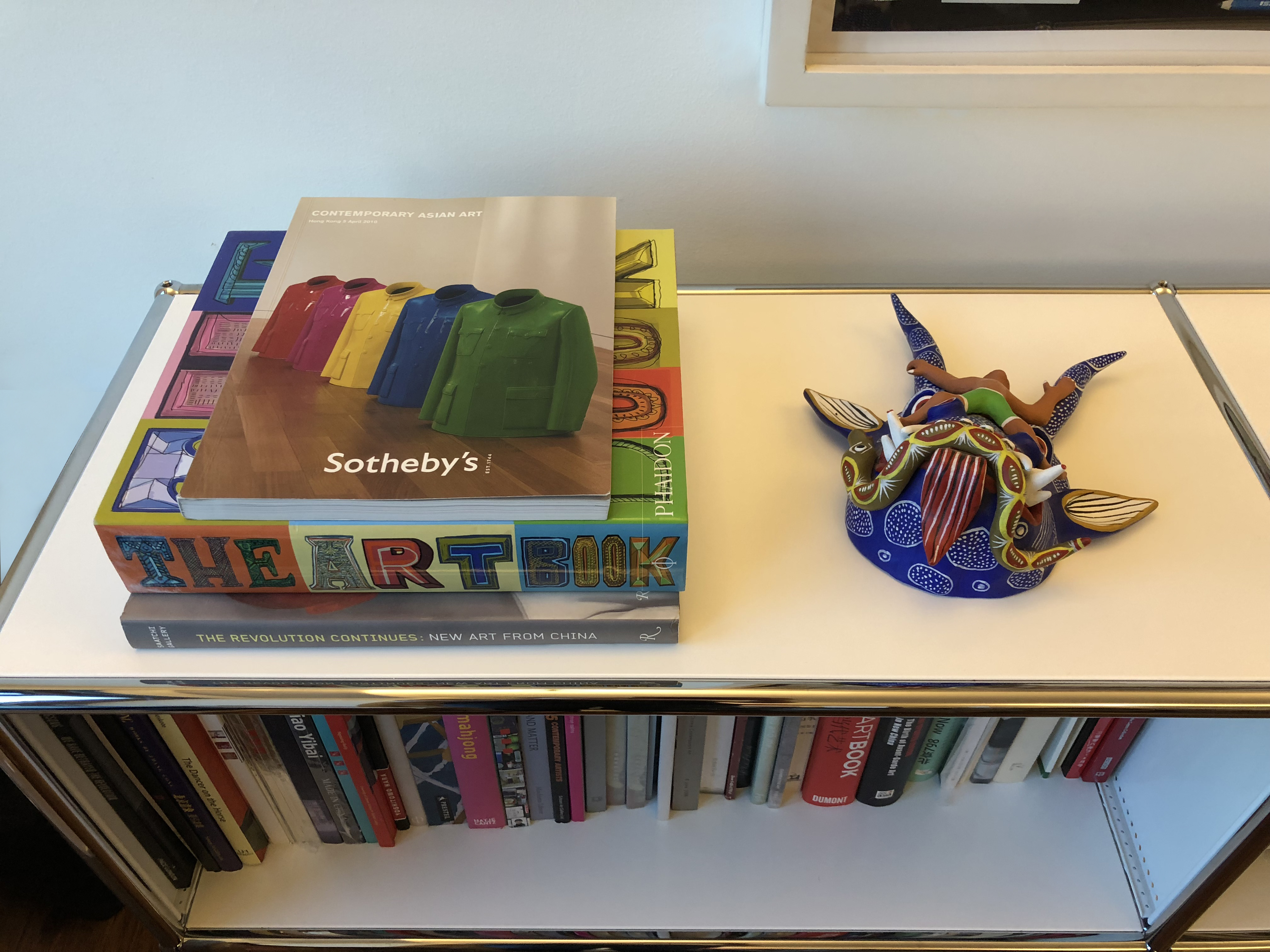

If a work comes in a set, buy the whole thing, not just a piece of it. We stumbled into the importance of this issue early on in our collecting. A dealer had a single sculpture available from a broken set of five Legacy Mantles by Sui Jianguo. My husband loved the work and really wanted the whole set, so our gallerist brokered a special deal to get it for us. Sui is one of, if not the best contemporary Chinese sculptor. His work almost never comes up at auction because once you have one, no one wants to sell them. Regardless, we’ve seen a few singular sculptures from this work at auction for far less than the list price for one when we considered it. In contrast, the only other unbroken set of Legacy Mantles turned up on the cover of a Sotheby’s catalogue a couple years after we bought ours…something that never hurts the provenance of your works.

Recognize that sellers almost always know what they have. None of us is likely to find a masterpiece in a thrift shop. In the past three months, I’ve had two friends of friends ask for help selling what they believed to be long, lost masterpieces. They both bought them as investments and thought they’d gotten the deals of the century. A few hours of research later, and I had to tell them that the works weren’t that valuable. Worse, they both paid retail or quite a bit above for them.

Art isn’t a good short-term investment. Be prepared to hold on to the art you buy for at least 10 years, if not 30. Flipping works isn’t easy. It takes an average of 12-18 months to sell a work, and that doesn’t guarantee that it’ll sell at a profit. Not to mention the whole blackballing thing that can prevent you from buying more works if you’re caught flipping.

If you do want to sell your art, carefully research your options. Auction houses are always looking for inventory. That’s how they make money. To increase inventory over the past few years, they’ve shifted all their commissions away from sellers and solely to buyers. Not having to pay a 12% commission can seriously improve your return on a work, but if your art isn’t important enough, auction houses won’t take your work on consignment. Or the right buyer might not be in the room, and your work might not sell at all, so it can be worth it to pay a seller’s commission to a dealer who regularly sells to clients who collect your artist.

Trying to buy art that holds or increases in value makes research imperative. If you want to build an important collection, art needs to become your obsession. Go see great art all the time. Read about art. Study artist’s CVs and their statements before you buy their work. Most important, develop your eye until you can spot the works that are really good, even before the artist is recognized for them by others.

Again, there are never any guarantees with art. But here’s a checklist of how to buy art that could be a good financial investment:

-Buy art that communicates something profound & universal

-Buy from artists who have distinctive voices

-Only buy art that’s well produced and in pristine condition

-Make sure you have the resources to take care of the work

-Buy inexpensive art from critically acclaimed artists early in their careers

-Buy the most expensive unique works you afford by blue-chip artists

-Buy the best examples of artists’ work

-Buy work you can hold over a long period of time

Holly Hager is an art collector and the founder of Curatious. Previously an author and a professor, she now dedicates herself full-time to help artists make a living from their art by making the joys of art more accessible to everyone.

top image // Legacy Mantles by Sui Jianguo on custom-made floating shelves in the living room of our Soho loft. Photograph courtesy of Andrew Prokos Photography